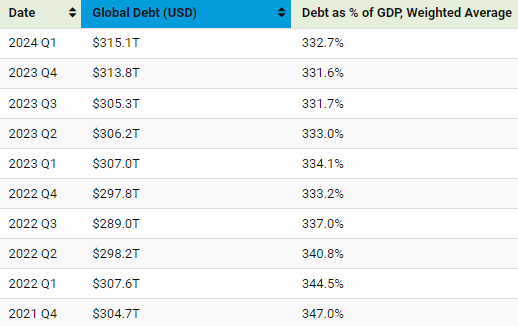

The global debt stock set a new record in the first quarter of 2024 by rising by $1.3 trillion in just three months. It is a common trend in all economies to see this flood of borrowing.

China, India, and Mexico drove the largest share in emerging markets while the US and Japan were the largest contributors across advanced economies.

As a result of rising debt servicing costs and mounting debt loads, the global debt-to-GDP ratio ultimately reached 333%.

Currently, global debt climbed to an all-time high of $315.1 trillion in the first quarter of 2024, according to Visual Capitalist.

The amount of debt in the world has increased by 21% since the pandemic began, adding $541 trillion to the total.

At $94.1 trillion, non-financial corporations currently hold the largest portion of debt, with government borrowings coming in second at $91.4 trillion.

In the meantime, households are in debt by $59.1 trillion and the financial sector is indebted by $70.4 trillion. Although stimulus programs encouraged borrowing, they are making many economies more fragile.

The cost of servicing American debt has surpassed defense spending, and interest rates are only going to go higher.

Consequently, in order to pay down its debt, the government might have to increase taxes or reduce spending. As of right now, neither political party has a substantial plan to deal with the fiscal sustainability of the nation.

Growing debt loads pose more of a risk to developing economies. In a high rate environment, these risks become much more acute if a nation experiences slow growth.

When borrowing becomes unaffordable in this scenario, many emerging markets might have to restructure their debt.

What is even more worrisome is that, in nearly one-third of emerging markets, per capita income has not increased since the pandemic, compared to levels recorded in 2019.

Emerging markets now hold $105 trillion in debt, up $55 trillion in the last ten years, as of the end of the quarter.