Luxury goods like art, watches, handbags, wine, automobiles, and even sneakers are now a viable alternative to traditional investment options like stocks, real estate, and gold.

However, the key question remains, is it a wise and worthy decision to invest in luxury goods.

According to a JP Morgan study, people tend to buy luxury goods when incomes rise. They spend more money on things they don’t really need. This is when the economy is doing well.

It is considered that the luxury goods can be a profitable addition to the investment portfolio. Here’s how:

1. Value appreciation

Investing in luxury goods can be financially rewarding since they frequently increase in value over time. The value of classic and iconic goods from well-known brands like Hermes, Chanel, or Rolex tends to rise as collectors and enthusiasts become more interested in them.

2. Tangible assets

Since luxury goods are tangible assets, you can enjoy them while their value may increase. In contrast, financial assets like stocks and bonds are immaterial and have no intrinsic value other than the possibility of a return on investment.

3. Inherent Quality

Luxurious goods are recognized for their outstanding craftsmanship and quality. Brands that are known for their accuracy, fine craftsmanship, and attention to detail are Louis Vuitton and Ferrari. These characteristics support the durability of luxury goods and their capacity to hold or grow in value over time.

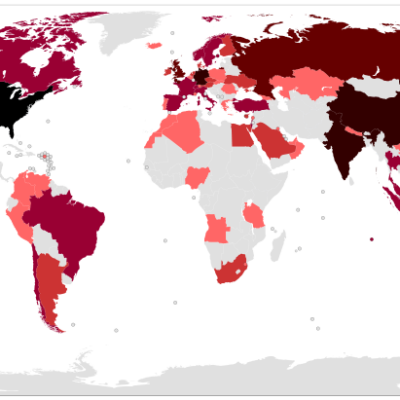

4. Global Demand

Luxury goods are very liquid investments because of their global market. The market for luxury goods is still strong, regardless of your preference for selling locally or reaching out to a global network of collectors.

5. Tax Benefits

Purchasing luxury goods could have tax benefits, depending on where you live and the local tax code. A higher overall return on investment can be achieved in certain jurisdictions where specific collectibles are given favorable tax treatment.