A crucial metric for assessing a nation’s financial health is the government debt-to-GDP ratio. It influences fiscal policy flexibility, gives information about the government’s ability to manage its debt, and has a significant impact on investor confidence.

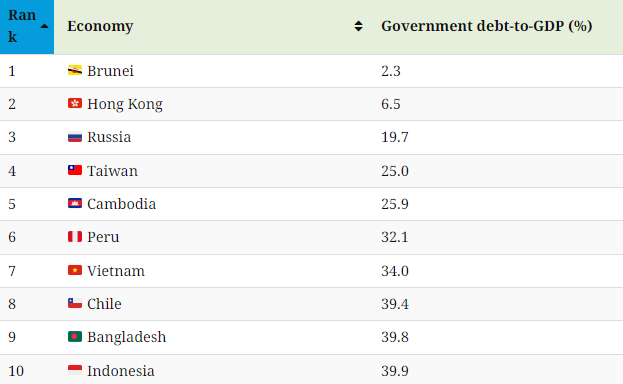

This list, which was produced in collaboration with the Hinrich Foundation, displays public debt as a proportion of GDP in 30 significant economies.

The World Economic Outlook from the IMF provided the data. The analysis is based on the 2024 Sustainable Trade Index (STI), which was created by the IMD World Competitiveness Center and the Hinrich Foundation.

Data Overview

The STI’s public debt metric was developed by converting IMF government debt-to-GDP ratios into a numerical index score. Each economy’s scores were then averaged to produce a range of 0 to 100.

Brunei’s comparatively low public debt-to-GDP ratio resulted in a high (and positive) STI government debt score. On the other hand, a low (and therefore unfavorable) STI government debt score corresponded to a relatively high public debt ratio, as in the case of Japan.

Ratios of public debt can offer crucial background information on a nation’s capacity to pay its debts. Additionally, a high ratio can limit economic growth, threaten economic stability, and impact investor confidence.

Options for fiscal policy may also be limited. It’s also critical to remember that high debt ratios may conceal significant dynamics that are hidden beneath the surface.

China’s federal government debt score, for instance, is very good. However, the nation’s financial stability is undermined by its high levels of local debt, which are not included in this measure.